The Quality Factor

Quality has become one of the most overused terms in investing. Nearly every manager claims to run a “Quality” portfolio, yet when you dig deeper, the definition varies widely. For us at Nutshell, Quality isn’t a marketing label – it’s a disciplined, measurable, and repeatable way of identifying companies that can generate excess returns over time.

Our Definition of Quality

When we talk about Quality, we’re looking for three core characteristics:

-

High Return on Invested Capital (ROIC): This is the clearest evidence that a business creates genuine value for shareholders. Companies that consistently earn more than their cost of capital are rare, and they tend to outperform over time as we’ll demonstrate below.

-

Consistent Margins: Healthy and stable margins indicate pricing power, operational resilience, and durable business models. Companies that can defend profitability through different cycles are better positioned to reinvest and grow.

-

Retained Earnings & Reinvestment: We prefer businesses that don’t just return cash to shareholders, but reinvest intelligently into their own operations. Compounding capital at high rates of return is one of the most reliable drivers of long-term wealth creation.

Quality as an Alpha Driver

Too often, Quality is framed as a defensive play - a place to hide when markets are volatile. We view it differently. When combining Quality with Valuation and Growth, we believe it is a source of alpha, not just risk control. High-quality companies are frequently mispriced in the short term. Our bi-monthly rebalancing process allows us to capture these inefficiencies and position the portfolio accordingly.

This view is supported by academic evidence that we've written about previously. Robert Novy-Marx, in his widely cited paper “The Other Side of Value: The Gross Profitability Premium” (2013), demonstrated that companies with strong profitability generate a persistent return premium, similar in magnitude to traditional value factors. We see this as clear support for focusing on measures like ROIC and margin consistency as part of a systematic investment process.

Why Quality Matters in a Higher-Rate World

The investment backdrop has shifted. In an era of near-zero interest rates, balance sheet strength was often ignored. Today, with capital carrying a real cost, the importance of Quality is amplified. Companies that generate free cash flow internally, defend margins in tougher environments, and sustain reinvestment without relying on leverage are in a stronger position to thrive.

The Compounder’s Edge

Ultimately, our approach to Quality is about owning tomorrow’s winners, not just today’s survivors. Businesses with the ability to reinvest retained earnings at high ROIC don’t just grow – they compound. And compounding is the engine of long-term wealth creation for investors.

Integration with Valuation, Growth and Technical Factors

It’s important to stress that we never view Quality in isolation. Quality companies can sometimes be expensive, growth companies can be fragile, and cheap companies can be value traps. Our edge lies in systematically integrating Quality, Relative Valuation, Growth and Technical factors into a single process. This ensures we capture businesses with durable economics, at the right price, with a path to compounding capital through our Fund’s repeatable process.

Growth Fund Metrics - Sustainably High

Every two weeks, we push each company within our immediate universe through a series of factors we believe are characterised by strong potential future returns. The below chart shows one of these factors, Net Profit Margin. The NPM is consistently high over the three-year period and over 3x that of the index. That’s Quality to us.

How has Quality Fared? – Compounding in Action

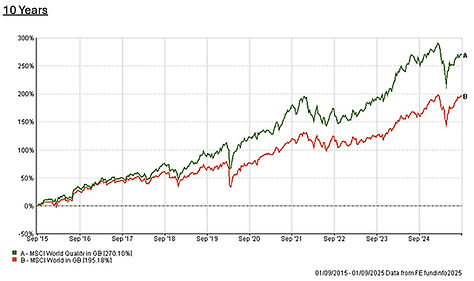

Over the past three years, performance for the MSCI World Net GBP was 36.14%, The MSCI World Quality Net GBP fared slightly better with 41.14% showing that quality factors have outperformed. The Nutshell Growth Fund returned 58.3%. When looking further out, predating our Fund, Quality has again produced some compelling results versus the broader MSCI Index. The 10 and 20-year figures are charted below. Max Drawdowns over that period were also less within the Quality index which helps to provide a better Sharpe and Sortino ratio over the longer term.

Conclusion.

Quality is more than a defensive factor. Done right, it becomes an alpha driver and the foundation of compounding wealth. At Nutshell, we don’t buy labels. We seek companies with repeatable economics and continually reassess their key metrics across a broad range of factors with Quality as a focal point.

By Chris Beament, Sales Director at Nutshell Asset Management

September 2025